cmart7327

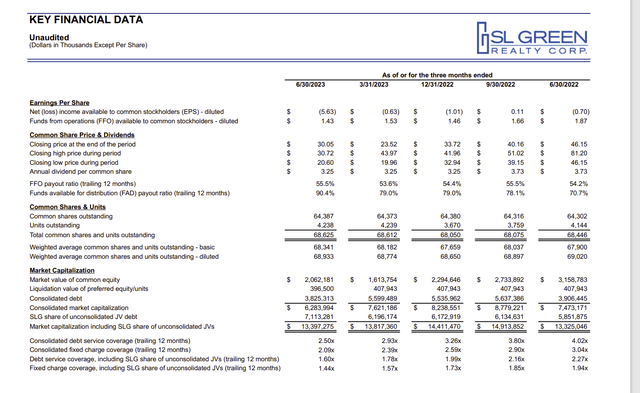

SL Green (NYSE:SLG) surprised the market by beating the Funds Flow (Funds Flow from operations of $1.43 compared to a consensus of $1.34) consensus for the second quarter. This was in addition to funding a building that the market also thought either would not be funded or would be a very costly funding. Management has stated numerous times that in a market like this, it is all about price and they were going in with their "eyes wide open" to existing conditions. The result is tight controls to allow a funds flow beat along with continuing guidance accomplishments that the market swore would never happen. Management may well increase the value of the business in a fiscal year when the market expected much less.

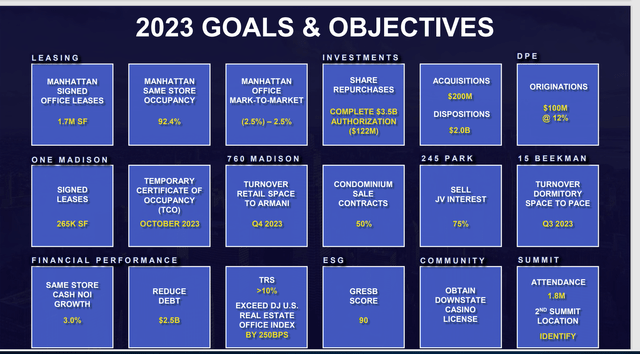

When management gave the guidance for this fiscal year, management also had a list of accomplishments to check off right in the presentation that investors could hold management accountable for. Such managements often succeed because they are being held accountable for their statements (guidance) by the market.

2023 Guidance

This management gives specific guidance in the following form:

SL Green Objectives For 2023 Summarized (SL Green Investor Day Presentation November 2022)

What happened since the guidance was given was a market focus on interest rates and the economy. Things like the banking crisis and more led to fears about the real estate market along with the ability of regional banks to survive and, by implication, the ability of companies like this one to roll over loans or just get financing in general.

This company spent much of the second quarter convincing the market that management was well aware of market conditions. Therefore, business in the form of goals could proceed.

Some examples:

This was the first announcement that went against "conventional wisdom:

Together with our joint venture partner, closed on the refinancing of 919 Third Avenue. The new $500.0 million mortgage has a term of up to 5 years and bears interest at a floating rate of 2.50% over Term SOFR, which the partnership has swapped to a fixed rate of 6.11%.

This was from the second quarter earnings press release. All by itself, it sort of stopped the stock price decline (for at least a little bit) in that this was something that was not supposed to happen. Now maybe the interest rate was on the high side. But supposedly the banking crisis made something like this an insurmountable challenge.

Next came the one that appears to have made a big difference in the pricing action. When this is combined with the unexpectedly strong Funds Flow From Operations announcement, it appears to have changed the market attitude towards this stock.

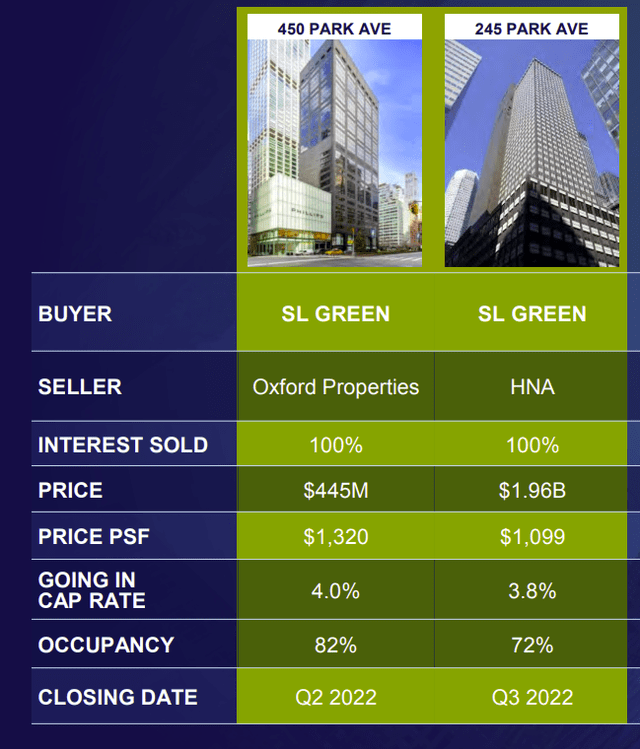

Closed on the sale of a 49.9% joint venture interest in 245 Park Avenue for gross consideration of $2.0 billion. The transaction generated net cash proceeds to the Company of $174.2 million.

The secondary reason why this is important is that the company had just purchased the property. Rising interest rates meant that the market thought that the company would "take a beating".

SL Green Transaction Details Of 245 Park Place (SL Green Investor Day Presentation)

It would appear from the stock price reaction at the time of the announcement that not only did the market not expect the announcement shown previously, but the market also expected the company to take a "significant haircut" if management were to complete the goal shown above.

Now the refinancing basically established the value just at the purchase price (very roughly). This whole transaction far exceeded market expectations.

Conclusion About Goals

Managements that do not give specific guidance and are somewhat vague about what needs to be done (other than "we have got to get through this") are the ones that often fail. This management is clearly not one of those managements.

The last piece of this is to have real estate located in a place where all of this is possible. Clearly this management has that location advantage.

SL Green management demonstrated that they are making some reasonable progress towards the established guidance shown above with those two transactions. Now, every management has a few goals not met and market conditions will change guidance. But the big deal here is that management is proceeding largely as planned and the stock price has now responded from what was a REIT industrywide freefall.

Going forward, management appears to have bought themselves some market goodwill. That will give management some flexibility with achieving the rest of the goals. But this stock is likely to have some solid fundamentals behind the recovering stock price in the form of management deals that meet guidance (adjusted somewhat for changing market conditions). To me, that is kind of amazing with all the worries right now. But it is also a benefit.

Taking Advantage Of The Quant System

One thing about cyclical stocks like this one is that sooner or later the market sentiment turns. This company has finances that are rated slightly under investment grade along with the steady goal accomplishments. Therefore, it should continue the stock price recovery as long as management keeps meeting its goal guidance within reason.

Many systems that outperform the market long-term do not pick up on a turnaround until it is well underway. Yet many cyclical stocks have their largest percentage gains early in the turnaround. Hence many investors will try to pick a stock with good chances of participating in the cyclical recovery.

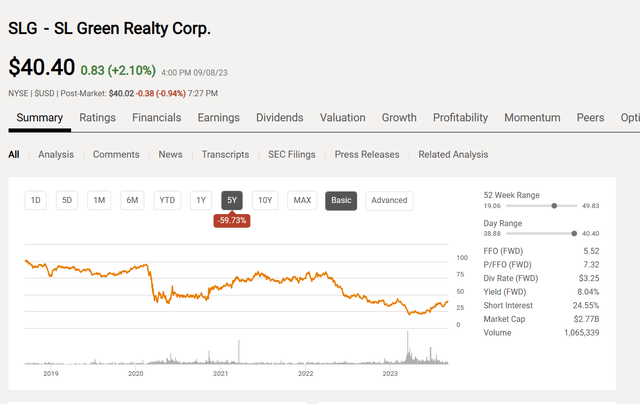

Seeking Alpha's quant system even had a warning out about under performance of this stock. As the chart clearly shows, the stock definitely had a period of underperformance.

However, it is also very likely that to take advantage of the recovery of the stock, an investor must consider investing in the stock while that warning exists. The reason is that any system like the quant system is a historical record that assumes that the stock will continue to perform as it has in the past. But all cyclical stocks can turn around.

Good managements often improve the business by at least the value of inflation, even including cyclical downturns. Many will do better. But the key is good management. The investor evaluation of that is essential.

This is why the establishment of the value of 245 Park Avenue was so important. The stock price was down on a lot of calls that commercial real estate values were plummeting, and disaster was just around the corner. Put that down as a specific example of Mr. Market going overboard as usual.

But management does not purchase and sell properties to maintain value. Management has a long-term goal to grow value. 245 Park Place, for example will be renovated as needed to increase the value. Therefore, if you believe that goal will succeed, then the stock price decline represents a bargain. The quant system is signaling a contrarian investment possibility.

Most of the great investors will tell you that they purchase bargains. They do not time bottoms. Therefore, they do not worry if the stock goes down before it goes up. What they worry about is that the upside exceeds the downside enough to account for the risk of being wrong this time. If they are right, they often participate enough in the early rallies that have big percentages.

Already there is an announcement about how the stock went up more than 50% from its low and therefore is now fully valued. That is very typical in the early stages of a recovery. For investors, that percentage will not be getting any smaller as long as the recovery does not derail.

SL Green Stock Price History And Key Valuation Measures (Seeking Alpha Website September 9, 2023)

Clearly this stock is in bargain territory and has been for some time as the stock price is roughly half of the high price shown above. That depends on management meeting their goals to increase the value of the business. That is also the risk that demands a close watch by investors.

Even now, the quant system has removed the warning because the stock has recently been climbing. That can mean a recovery has begun that would lessen downside risk. Investors should expect the Quant system rating to climb as the recovery continues. But that only happens if management continues to meet guidance reasonably well. The quant system improvement is one of several measures an investor can use to determine that the recovery remains on track. Certainly, the usual due diligence is required. Recoveries can derail. The stock has performed better than the market recently and is likely to continue that performance to raise the quant system rating.

Seeking Alpha Quant Ratings For SL Green (Seeking Alpha Website September 9, 2023)

It should be obvious to anyone dealing with cyclical stocks (that are good turnaround candidates) that at this stage of the recovery (the beginning), companies are not very profitable, nor do they show a lot of earnings growth. Had that been the case, there would not have been a stock price decline. All of that will change if the recent price action is correct. The market looks forward while the quant system is past history continuing.

(Note: financially weak stocks often do not make it to turnarounds or through turnarounds.)

"Safe" turnarounds (or at least relatively safe) are generally driven by managements that are considered superior. (Decent finances are also required.) These managements often accomplish things like this management has when the market least expects it. The result is that a company like this one will likely lead the recovery and may even trade at a premium in the future.

Things to watch here are the "Rank in Industry" needs to remain high over time and the "Ranked in Sector" needs to continue to climb for the recovery to continue. Growth and Profitability probably need more time before they improve. They are historic measures as a rule and so that trend takes time to establish.

Likewise, the investor needs to set a sell value before the investment decision is made because cyclical stocks often look cheap near the top of the market. Therefore, it takes some discipline to sell a cyclical stock when the market and a lot of rating systems are screaming buy or maybe hold.

Earnings Summary

Probably the earnings summary should not have been a surprise. Management has noted for some time that the recovery from fiscal year 2020 will continue.

SL Green Earnings Summary Second Quarter 2023 (SL Green Second Quarter 2023, Earnings Press Release)

The funds flow will likely turnaround at some point in the future as management continues to fill up the properties. Now that will not be straight line progress. But unless something dramatic, such as unforeseen material interest rate increases happen, the progress since fiscal year 2020 is likely to continue.

It is also wise to watch the income as that needs to become profits during the recovery as well. It is true that the depreciation often allows for decent cash flow when an REIT reports a loss. But long term, this business is here to make money just like any other business. To do that, profits are needed at some point in the cycle. Management likewise needs to continue to report gains on the sale of real estate for the same reasons.

Debt Rating

Another key to success is a decent debt rating. The debt rating here is not that far away from investment grade. Now there may be a negative outlook until the industry recovery is well established. But management appears to have the controls in place to get the rating back up if there is a reduction.

Like the Quant system, ratings companies typically follow the trend. Therefore, it is not unusual for them to caution near market bottoms. It is however, to management's advantage to keep the debt rating decent so that refinancing costs do not get out of hand.

There is a risk that interest rates remain high. But the risk of an inverted yield (which often, but not always, accompanies high interest rates) curve persisting will decline as long as inflation continues to come under control and the government deficit continues to decline. It would take a strongly overheated economy to persist for some time before there is a risk of higher interest rates causing future issues.

Key Ideas

I like good management as it is often the biggest asset not on the balance sheet. Good management is a necessary item to survive in cyclical industries. With SL Green, you have a management that set goals in the investor update and is proceeding to "check boxes" as those goals are met. This management is likewise not afraid to mention what did not get accomplished.

That kind of blunt management is relatively rare. But it is also very reassuring to the market. The stock market clearly has responded to the $200 million dollar announcement as that financing was in doubt (especially at the value it was accomplished at). But that also shows that management had realistic goals for a perceived tough market. In this case, management and investors "can check boxes" (so to speak) as specific goals are accomplished. Clearly this management is succeeding in a rough environment while others either tread water or worse.

The beat that was reported for "Funds Flow from Operations" shows tight control that many managements would have you take for granted. This management also goes "the extra mile" by annually declaring a stock split and then an immediate reverse split to allow them to keep more money than the typical REIT. That allows additional financial flexibility that many REIT managements never thought of.

This stock remains a strong buy as it has to double (approximately) from current levels to get back to the previous levels of the last business cycle. The stock will likely be volatile at the beginning of a recovery. That should be expected. But as the earlier chart shows, a recovery in the stock price is clearly underway. So, investors can consider getting in expecting the quant system to recognize the recovery a little more.

"come" - Google News

September 13, 2023 at 04:55PM

https://ift.tt/tajgkAu

SL Green: Good Management Is Hard To Come By (NYSE:SLG) - Seeking Alpha

"come" - Google News

https://ift.tt/wcsrtAv

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "SL Green: Good Management Is Hard To Come By (NYSE:SLG) - Seeking Alpha"

Post a Comment