Dan McNamara has been to his office at a hedge fund in New York only a handful of times since the coronavirus pandemic was declared in March 2020.

On the days he did go into the office, he would look around at all the empty floors in buildings across Manhattan and couldn’t help but wonder if the pandemic had fundamentally changed companies’ need for office space.

It didn’t take him long to conclude that it had.

A principal at MP Securitized Credit Partners who specializes in trading commercial mortgage-backed securities, McNamara last year helped create an investment vehicle to make short bets on bonds backed by CRE loans, including office loans. The thinking was that office workers would not be rushing back into high-rises even after the virus fades, resulting in climbing office vacancies and falling property values. The fund has already generated a 120% return to investors.

"It’s not going to be a complete debacle that regional malls are, but there will be some problems,” said McNamara, whose firm first gained notoriety shorting securities tied to mall loans. The office market has traditionally been one of the safest bets in real estate finance, but now lenders and investors “have to be very careful,” he said.

The commercial real estate industry and the banks that support it have grappled with the demise of brick-and-mortar retail spots and stockpiled reserves for losses from hotels quieted by the virus. But at the end of last year, problems started showing up in the office sector. More square footage is going unoccupied, delinquencies have started edging up, new loans are dwindling and borrowing costs are creeping higher, all signs that the business is growing riskier.

Now, many banks are planning to pull back from financing office projects this year, executives said, and opinions vary on when, or even if, the office market will bounce back.

“Everybody thought that office, even though people are clearing out and working from home, that the leases are still in place and that market would hold up,” said Matt Anderson, a managing director at the data analytics firm Trepp. “Now, there have been some cracks in that theory.”

‘Work-from-home is here to stay’

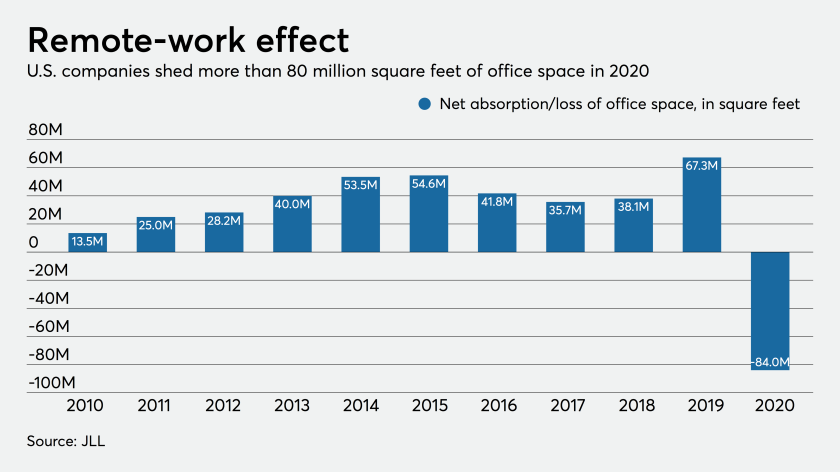

Slightly more than 84 million square feet of office space went from occupied to empty in 2020, according to data from the real estate firm Jones Lang LaSalle. That drop is especially stark when compared with the 67.3 million square feet of increased occupancy in office space the year before. And it’s the first time in more than a decade that the company’s researchers recorded occupancy losses at all.

About half of the space that went unoccupied was abandoned in the fourth quarter alone, the data shows.

Delinquencies on office debt have so far been kept in check as companies have largely been paying their leases, even on space that now sits empty. The delinquency rate on office loans on bank balance sheets did tick up, however, to 0.44% in the third quarter last year from 0.27% three months prior and about quadruple the rate one year before, according to Trepp data.

Associated Banc-Corp in Green Bay, Wis., is expected to increase commercial real estate lending in 2021, executives said on a Jan. 21 call with analysts, but the focus will likely be on loans for multifamily and industrial projects. For now, the $33.4 billion-asset company is pausing on office, Paul Schmidt, head of commercial real estate at Associated Bank, said in a recent interview.

“It’s going to shift,” Schmidt said. “New office development is certainly going to slow.”

Roughly 20% of Associated’s commercial real estate lending business is tied to office space each year, but in 2020 that dropped to 15% and this year it is likely to fall to 10%, Schmidt said.

To be sure, the dropoff in CRE lending has been dramatic across all sectors. Banks originated less than $4.7 billion of total commercial real estate loans during the fourth quarter, down 22% from the third quarter and half the level seen a year earlier, according to Trepp.

Office lending last year, in particular, ran at about 21% of the average production pace in 2019, Trepp data showed. By contrast, multifamily originations were at 70% of 2019 levels and industrial loans were at 66%.

“Out of all the commercial real estate sectors, the future of office is the most difficult to discern,” said Cal Evans, who does credit intelligence for Synovus Financial in Columbus, Ga. “But the reality is work-from-home is here to stay.”

Evans had been scheduled to speak at a conference Synovus was hosting in Miami on March 11 of last year. The company had been monitoring the increasingly troubling spread of COVID-19 and decided to call off the event. Evans could see instantly the dollars lost across commercial real estate, hotels, convention centers and offices.

“Right then I knew we were going home and this was going to be significant,” he said.

Like Associated, Synovus is taking a cautious approach to office lending. What business is done might be focused in the less-crowded suburban markets of the company’s footprint in the Southeast, Evans said. There could also be opportunities for lenders to offer financing to companies that are tapping so-called mezzanine debt to keep paying on their office loans and leases. Even further out, Evans said, there might be more demand for loans to retrofit offices with better healthcare measures like safety glass, redesigned floor plans to give employees more space and air filtration systems.

“Property technology for building management systems will replace luxury amenities,” Evans said.

Any new lending will also require a more-detailed set of underwriting guidelines to account for which companies will be leasing out a new office building and how committed they are to maintaining a work space, Schmidt at Associated said.

“You need to spend more time analyzing the tenant base than we would have in the past,” Schmidt said. “You want to make sure those who have signed the leases are in an industry that wants and needs office space.”

Schmidt said he remains optimistic that the need for office space will come back, just in a different form.

“We seem to forget the past and move ahead,” he said. “For that reason we’re taking a wait-and-see attitude. Some companies are continuing to pay rent. They don’t want to give it up.”

The office ‘needs a rethink’

In the second quarter of 2020 alone, $35.5 billion in CMBS debt fell into what’s known as special servicing, when control of the loan is taken over by a company that works out a deal with the borrower in order to avoid a costly foreclosure, according to the most recent data from Fitch Ratings.

Hotel and retail loans accounted for the vast majority of the transfers, but office loans made up the third-highest share, at 8%, and researchers expect that figure to increase.

“Future transfers to special servicing will likely be driven by loans secured by office and retail properties, given longer-term leases,” Fitch said in its report.

Stacey Berger, an executive vice president of the special servicing company Midland Loan Services, said that in the office sector, loans tied to shared co-working spaces are those most in need of special servicing.

Banks and servicers have been able to offer payment deferrals and other workouts without being penalized by examiners, according to a March 2020 bulletin from the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency.

Scott Siefers, an analyst at Piper Sandler, said regulators will eventually force banks to account for the damage, but that it’s still uncertain when that will be.

“Regulators have been ultraflexible to let them work with borrowers and not mark them down,” Siefers said. “At some point that will stop.”

For property owners, the cost of borrowing is increasing.

Readings International, which operates movie theater brands like Angelika and manages other properties, was in the middle of leasing up a retail and office building under construction in New York when the pandemic hit. Its lender, Bank OZK in Little Rock, Ark., granted an extension of the maturity date on the loan by several months to March 31, 2021, according to a Jan. 11 filing from Readings. The interest rate, however, increased to 17.5%.

The deal gave Readings time to find a suitable way to refinance the debt, the company said in the filing, but it also highlighted how much banks are now pricing in risk.

Banks at one point were charging on average three percentage points more on office loans they hold on their balance sheets compared to rates on ultrasafe U.S. Treasury bonds in the first quarter, according to data from Trepp. This difference more than doubled from the end of 2019, a sign that banks suddenly viewed the office sector as much riskier than they did a year earlier.

While the spread has since come down to a little more than 2 percentage points above Treasury rates as some firms have reopened offices, the spread on office loans is still higher than what’s being charged on loans from other sectors like industrial, multifamily and even retail properties, according to Trepp.

Neil Murray, who took over as chief executive of Jones Lang LaSalle’s corporate solutions business about a year before the pandemic hit, helps companies and many banks manage their portfolio of commercial real estate debt.

He said some CEOs have told him they’re eager to bring workers back into the office, believing it will give them a competitive advantage over rivals keeping employees at home. Such sentiments are stoking optimism in real estate circles that the office market could soon return to normal.

“We hear stories of people working 12 hours a day on a beanbag,” Murray said. “It’s not good for them.”

Murray said it might take until next year, but he believes there will be an opportunity for banks to help finance the reimagining of U.S. office space.

As he sees it, people have a fundamental need to be around each other to accomplish projects that can’t be done over Zoom. Those employees returning could need more, not less, space, to be with their colleagues while still adhering to social distancing guidelines that are likely to stick around for a while.

Office space will also need to be more inviting, Murray said.

“The days of a task-focused cubicle and no natural light are over,” he said. “We weren’t thinking about what the space was for and were expecting people to show up to pretty banal places. That needs a rethink.”

"come" - Google News

March 01, 2021 at 09:00AM

https://ift.tt/2MzyD2f

CRE lenders' growing fear: Office workers won't come back - American Banker

"come" - Google News

https://ift.tt/2S8UtrZ

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "CRE lenders' growing fear: Office workers won't come back - American Banker"

Post a Comment