The energy industry is going through a major transition as the global economy switches fuel sources. However, this pivot toward cleaner power will take decades and trillions of dollars in investment. Given the size and duration of this megatrend, both traditional energy stocks and those focused on cleaner alternatives could generate strong returns for years to come.

Three energy companies in an excellent position to produce market-beating total returns over the coming years are Enterprise Products Partners (NYSE:EPD), Enbridge (NYSE:ENB), and Brookfield Renewable (NYSE:BEP)(NYSE:BEPC). Here's why our energy contributors like this trio's potential to outperform.

Image source: Getty Images.

Big, strong, and diversified in this vital energy niche

Reuben Gregg Brewer (Enterprise Products Partners): The midstream sector is deeply out of favor today because of its position helping move energy from where it is drilled to where it eventually is used. But don't count this industry niche out. Sure, energy majors are selling assets, but someone is buying them, and the acquirer will continue to operate them. That means the need for midstream companies is still there.

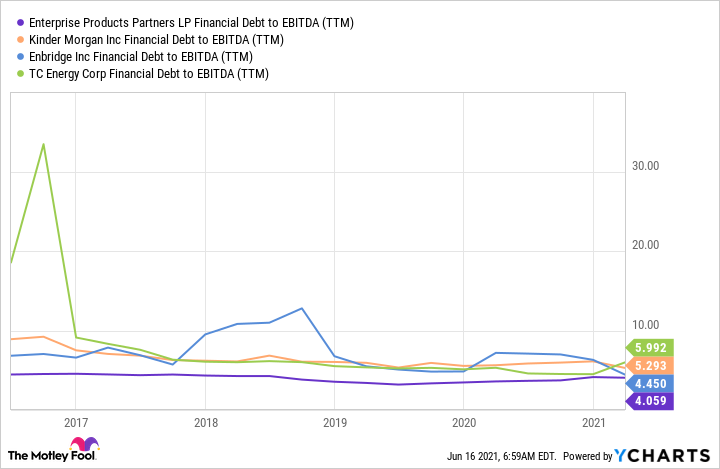

Master limited partnership Enterprise Products Partners sets itself apart from the pack because of its size and financial strength. Its $55 billion market cap makes it one of the biggest midstream names in North America, with a portfolio of assets that is both diversified and, likely, irreplaceable. Meanwhile, its 4.1 ratio of financial debt to EBITDA is toward the low end of the industry (right where it has historically lived) and signifies a strong balance sheet. And it covered its distribution by a hefty 1.7 times in the first quarter.

EPD financial debt to EBITDA (TTM) data by YCharts. TTM = trailing 12 months.

These are important facts because they suggest that Enterprise can muddle through whatever headwinds exist today while still paying investors well for sticking around. But it also means that Enterprise can be a consolidator in the midstream space should ground-up growth opportunities permanently stall. So even if things stay tough in the industry, Enterprise will still have ample opportunity to outperform.

This Dividend Aristocrat is built to last

Neha Chamaria (Enbridge): Three factors can broadly dictate whether an oil and gas company can outperform the market in the long run: cash-flow generating capability, dividend track record, and growth plans. Enbridge passes the test on each count.

To begin, midstream oil and gas companies are best poised to ride out the volatility in oil prices as they primarily store, process, and transport hydrocarbons like crude, natural gas, and natural gas liquids. And therefore, they can generate steady cash flows, unlike oil producing companies, even when oil prices are low. Enbridge, which operates the world's longest transportation network, accounts for nearly 40% of the total crude oil imports in the U.S. and is Canada's largest natural-gas utility.

Thanks to predictable cash flows, not only has Enbridge increased its dividend for 26 straight years, but it has also grown that payout at a solid annual compound rate of 10% over the period. You only have to see one chart to understand how Enbridge's dividend growth is behind the stock's massive total returns that have beaten the market handsomely in the past couple of decades.

ENB data by YCharts.

There's little chance Enbridge's streak of annual dividend increases will be broken anytime soon given the potential rise in global demand for energy. Enbridge is also investing in renewable energy, and projects that its distributable cash flow (DCF) per share will grow at a compound annual rate of 5% to 7% through 2023, driven largely by its multibillion-dollar capital spending plans. As DCF grows, so should dividends, which should be reflected in the stock price of this 6.8%-yielding energy Dividend Aristocrat.

This wealth creator has plenty of power to continue enriching investors

Matt DiLallo (Brookfield Renewable): Brookfield Renewable has a long history of outperforming the market. The leading global renewable energy producer has generated 20% compound annual returns since its inception. That has significantly outpaced the S&P 500's 7% annualized total return during that time frame.

Powering that strong performance has been Brookfield's ability to grow shareholder value. The company has expanded its funds from operations (FFO) at a more than 10% compound annual rate on a per-share basis over the past decade by steadily growing its renewable energy portfolio. That's given it the power to increase its dividend at a 6% yearly pace since 2012.

Brookfield's future is even brighter. The company estimates it can organically grow its FFO per share by 6% to 11% per year through at least 2025. Powering that forecast is rising power rates and its vast pipeline of high-return renewable energy projects. On top of that, Brookfield believes future acquisitions could add as much as 9% of additional incremental FFO per share each year. That should give it plenty of power to grow its 3%-yielding dividend at a 5% to 9% yearly rate.

Brookfield could continue growing FFO and its dividend at strong rates for decades to come, given what's ahead for the renewable energy megatrend. This powerful combination of growth and yield could help fuel exceptional total returns for Brookfield's investors in the coming years.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

"come" - Google News

June 19, 2021 at 07:46PM

https://ift.tt/3gC8CeS

These Energy Stocks Could Outperform the Market for Years to Come - The Motley Fool

"come" - Google News

https://ift.tt/2S8UtrZ

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "These Energy Stocks Could Outperform the Market for Years to Come - The Motley Fool"

Post a Comment